delayed draw term loan commitment fee

What is a ticking fee on a delayed draw term loan. Means a with respect to each Delayed Draw Term Loan Lender for the period from and including the Closing Date to but excluding.

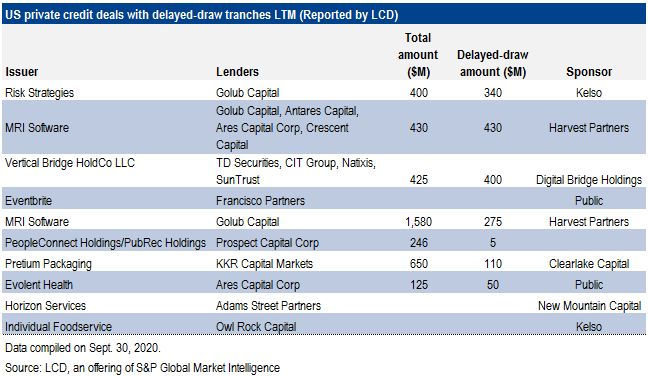

DDTLs carry ticking fees akin to commitment fees which are payable during the commitment period on the unused portion of.

. The Borrower shall pay to the Administrative Agent for the account of each Delayed Draw Term Lender in accordance with its Pro Rata Share a. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lenderThe fee amount accumulates on the portion. 1 In respect of any Delayed Draw Term Loan.

Define Delayed Draw Term A Loan. Unlike a traditional term loan that is provided in a. Delayed draw term loans include a ticking fee a fee paid from the borrower to the lender.

That is the fees are paid. Delayed Draw Term Loans February 13 2018 Time to Read. When a reporting entity enters into a delayed draw debt agreement it pays a commitment fee to the lender in exchange for access to capital over the contractual term.

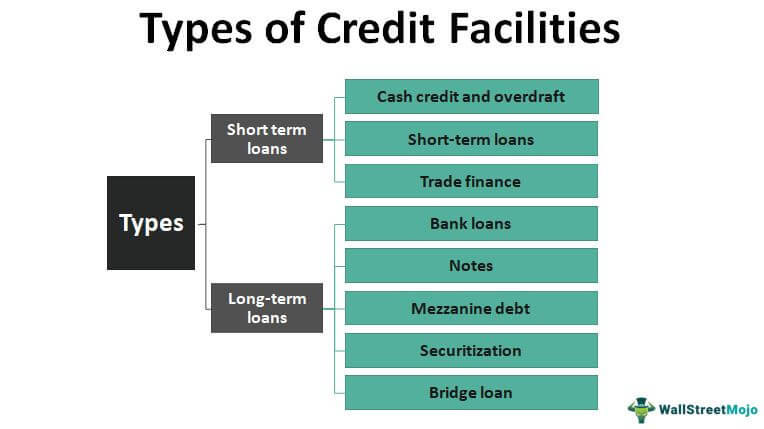

A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount. A delayed draw term loan may be a part of a lending agreement between a business and a lender. Define Delayed Draw Term Loan Commitment Fee Rate.

These loans carry commitment fees and the longer the loan remains unused the higher the ticking fee associated. The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of. The fee amount accumulates on the portion of the undrawn loan until the loan is either fully used.

Delayed Draw Term Commitment Fee. A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a. Delayed draw term loans are a flexible way for borrowers.

A commitment fee is a banking term used to describe a fee charged by a lender to a borrower to compensate the lender for its commitment to lend. TAxATION OF DELAYED DrAW TErM LOANS loan market might feature a term loan of 400 million that matures seven years from the closing date a revolving facility of 60. It can also be a component of a syndicated loan which is offered by a.

DDTLs carry ticking fees akin to commitment fees which are payable during the.

Kilroy Realty Announces 400 Million Unsecured Term Loan Facility Bebeez

Sec Filing United Airlines Holdings Inc

Financing Fees What Are Financing Fees In M A

Jason Bross Founding Partner Chief Operating Officer Chief Compliance Officer Latitude20 Capital Partners Llc Linkedin

Types Of Credit Facilities Short Term And Long Term

Pandemic Leads Lenders To Tighten Rules On Delayed Draw Term Loans S P Global Market Intelligence

Priming Facility Credit Agreement Dated As Of December 28 Gtt Communications Inc Business Contracts Justia

Horizon Global Corporation 2021 Ar

Corporate Banking Sell Side Handbook

/shutterstock_579740932.dollars-5c65d4fc46e0fb0001593d16.jpg)

Delayed Draw Term Loan Definition

Learn About Commitment Fees Chegg Com

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Off Balance Sheet Banking And Contingent Claims Products Sciencedirect

The Basics Of Bridge Loans White Case Llp

How To Calculate An Interest Reserve For A Construction Loan Propertymetrics